This article introduces The STEEPLE Analysis – Economic Opportunities and Threats: Inflation, Employment, Economic Growth and International Trade Balance.

An economy is a system that attempts to solve the problem of scarcity. Therefore, the main function of an economy is to allocate scarce resources among limited needs and unlimited wants of customers.

There are three main types of economic systems including: free market economy, command (planned) economy and mixed economy. Within each economic system, there are four market conditions: perfect competition, monopoly, monopolistic competition and oligopoly.

The economic environment refers to the state of the economy in which all businesses operate, and is determined by the government’s ability to achieve four key economic objectives to:

- Control inflation.

- Reduce unemployment.

- Achieve stable economic growth.

- Maintain a healthy international trade balance.

1. Control inflation

What is inflation?

Inflation is the trend of increasing prices – continual rise in the general level of product prices in the economy.

Why inflation matters?

Inflation can complicate business planning and decision-making. Inflation will cause increases in prices of inventories used to produce goods and provide services. Employees will be asking for higher wages and salaries and their relative purchasing power will decrease. Businesses will modify catalogue and menu prices, therefore there will be cost of changing prices frequently. Unpredictability may discourage entrepreneurs and investors, and world economies will see changes in relative prices between different countries.

What causes inflation?

There are two factors in the economy that cause inflation: excessive demand and higher costs.

- Excessive aggregate demand from customers caused by rise in consumption, government spending or international trade earnings. Households and businesses will spend more money at a faster rate when income levels are very high.

- Higher costs of production caused by strong push for increased wages (e.g. trade union actions, job switching), soaring raw material prices (e.g. an oil crisis, health epidemics) or higher rents (e.g. unreasonable demands from landlords).

Countries with low inflation

Keeping inflation low is a prerequisite to achieving reduced unemployment, stable economic growth and a healthy international trade balance. Countries with low inflation will enjoy economic prosperity.

What if inflation is not controlled?

Uncontrolled galloping inflation is a serious threat to businesses because of higher unpredictable costs and uncertainty on the markets. Inflation will not only lead to a rise in prices domestically, so that local firms can maintain their profit margins, but will also affect the international competitiveness of a country as goods may become too expensive for buyers in other countries.

Countries with high inflation

A country with a relatively higher inflation rate will be less price-competitive when trading overseas leading to higher unemployment, poor economic growth and a fall in export earnings causing trade deficit.

2. Reduce unemployment

What is unemployment?

The unemployment rate measures the proportion of a country’s workforce that is able to work but is not in official employment because of various reasons.

Why unemployment matters?

There are many social costs of high unemployment. The problems with having a lot of citizens without work include high social security costs (e.g. unemployment benefits paid by the governments), low consumer spending of the general population which pose threats to business growth, depression which treatment will strain public health system, low self-esteem of the unemployed, etc.

Countries with high unemployment

A country with high unemployment will suffer from poverty and increased crime levels, burden on TAX payers to support government spending on welfare benefits for the unemployed and the country’s low international competitiveness.

How to tackle unemployment?

The government can use a combination of policies to tackle unemployment, depending on the types and causes of the unemployment.

- Reduce Individual Income TAX. The government can lower individual income TAX to increase spending to boost the level of consumption in the country.

- Reduce Corporate TAX. The government can lower corporate TAX to stimulate business activity and investments in the long-term as more entrepreneurs will start businesses hoping for higher net profits.

- Reduce Interest Rates. The government can lower interest rates (the cost of borrowing money from the bank) to encourage individual consumers and businesses to borrow more cheaper, therefore increase the level of consumption as people will have more money to spend.

- Increase government spending. The government can increase spending on public education, public hospitals, training programs for unemployed workers, construction of public infrastructure, boosting military capabilities, etc.

- Protect home businesses. The government can use protectionist measures to safeguard domestic businesses (and jobs) from international competition that may cause local businesses to go out of business hence causing massive layoffs.

Countries with low unemployment

Most of the citizens have jobs meaning that individual spending power of the society will be relatively high. It will increase sales revenue for businesses and demand for suppliers. Revenue from both Individual Income TAX and Corporate TAX will be high, meaning opportunity for increased government spending on public goods while less spending on benefits for the unemployed.

3. Achieve stable economic growth

What is economic growth?

Economic growth is the increase in a country’s economic activity over time.

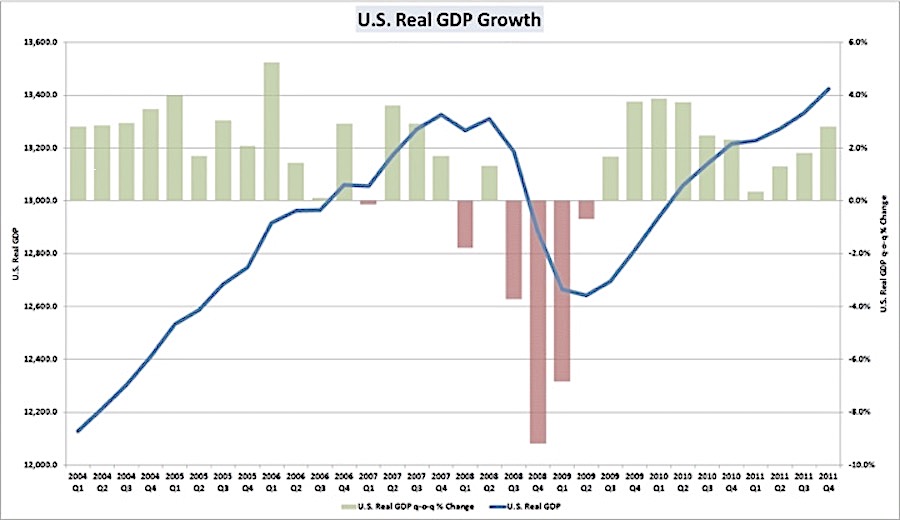

How to measure economic growth?

Economic growth is measured by the change in the annual value of the economy’s total output (Gross Domestic Product (GDP)).

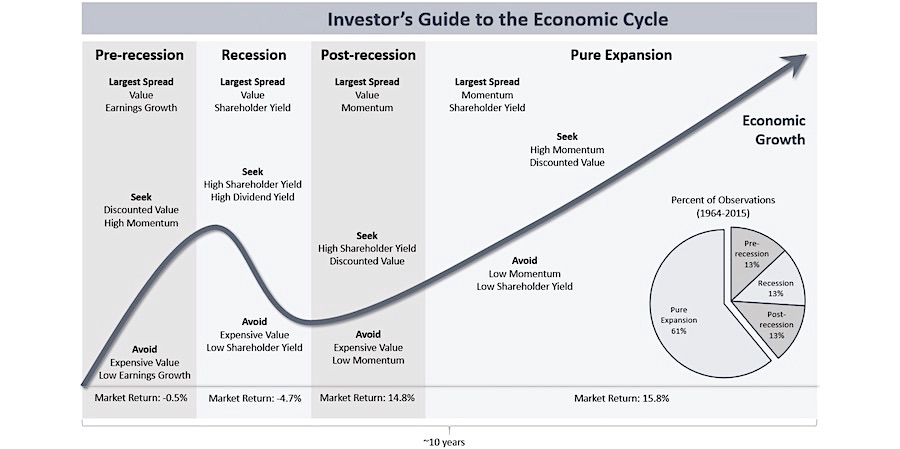

Economic growth cycles

The business cycle is the pattern of fluctuations in economic growth. There are five stages in each economic cycle:

- Expansion. During a boom, the level of economic activity measured by the economy’s total output (GDP) is increasing. Consumer spending is increasing too. So are earnings from export and investment.

- Peak. At the peak, economic activity is at its highest level. The rate of unemployment is the lowest (the closest to 0%). Consumer confidence is very high resulting from higher incomes and robust opportunities for employment. Business confidence levels are also high resulting in higher levels of profit.

- Contraction. A recession occurs when there is a fall in the level of economic activity measured by the economy’s total output (GDP) lasting for two consecutive quarters (half a year). During the recession, aggregate demand from customers will decline, so will export sales and investment. The rate of unemployment will increase. Many businesses will suffer from lower sales, especially those with a small range of products, or selling products that are sensitive to changes in incomes (e.g. expensive houses, high-end cars, luxurious jewelry or overseas holidays).

- Trough. A slump refers to the bottom of a recession. It is the last stage of decline in the business cycle. There will be high unemployment alongside very low levels of consumer spending. Export earnings will be minimal and investment barely existing. Many businesses will suffer from poor cash flow and many will have already closed down due to insufficient money to run the business. Consumers have little confidence in the economy. Workers will suffer job losses or a lack of job security.

- Recovery. Recovery occurs when the economy’s total output (GDP) starts to rise again, after a slump. The level of consumption, production, investment, exports and employment will all gradually increase creating more opportunities for businesses.

Countries with high economic growth

Higher rates of economic growth suggest that the economy is more prosperous. The average person is earning more income and there are more opportunities for businesses.

Countries with low economic growth

Lower rates of economic growth suggest that the country is poorer, finding it difficult to grow and create business opportunities. There are many barriers to economic growth such as a lack of basic infrastructure such as schools, shops, hospitals and housing, poor access to utilities (i.e. electricity, water, gas), poor transportation networks (i.e. roads, ports, railways, airports) and communications networks (e.g. mobile networks, the Internet). There are also restraining forces for many businesses that wish to expand overseas.

4. Maintain a healthy international trade balance

International trade means exchange of goods and services between two countries. Specifically, this includes import and export activities.

There are two main reasons for international trade including: obtaining goods that cannot be produced locally and obtaining goods that can be imported cheaper than in a home country.

What is trade balance?

The internal trade balance of a country shows the value of the country’s export earnings and its import spending.

International trade should be balanced

Governments should strive to avoid a deficit on their international trade balance (import spending exceeding export earnings). It is because countries (the same as individual people) are not able to spend more than they earn in the long run to sustain themselves without borrowing.

Trade Surplus: Imports < Exports

A trade surplus occurs when a country does produce everything it needs and even more, so it sells surplus of its own home products to other foreign countries that pay for the exports. The government could appreciate home currency to achieve trade balance (imports = exports).

Trade Deficit: Imports > Exports

A trade deficit occurs when a country does not produce everything and it needs to buy products from foreign countries and pay for those imports. Sometimes, if a country does not have enough earnings from exports, it will need to borrow from other countries to pay for those imports. The government could depreciate home currency to achieve trade balance (imports = exports).

How to correct imbalance in international trade deficit?

To correct an imbalance on its international trade balance, the government can often attempt to alter their exchange rate, or set international trade barriers. Both actions provide opportunities and threats for businesses.

1. Alter exchange rates. The exchange rate is the price of one currency in terms of another. It measures the value of the domestic currency in terms of foreign currencies. And it is determined by the demand and supply of home currency in the foreign exchange market.

a.) Currency Appreciation. This means an increase in external value of a home currency as measured by its exchange rate. Appreciation means that the home currency has increased in value. A higher exchange rate means that prices of products imported from abroad into a country will be relatively lower. Cost of buying overseas will decrease meaning that importers will need less home currency to buy the same number of overseas products. It is good news for importers of raw materials. On another hand, the prices of product being exported overseas will increase for foreign buyers, meaning foreign buyers will need more overseas currency to buy the same number of products. So, it is bad news for companies selling products abroad.

(!!!) Currency appreciation will increase imports and decrease exports.

b.) Currency Depreciation. This means a decrease in external value of a home currency as measured by its exchange rate. Depreciation means that the currency has decreased in value. A lower exchange rate means that prices of products exported abroad will now be cheaper for overseas buyers. A lower exchange rate means that prices of products imported from abroad into a country will be relatively higher. Cost of buying overseas will increase meaning that importers will need more home currency to buy the same number of overseas products. It is bad news for importers of raw materials. On another hand, the prices of product being exported overseas will decrease for foreign buyers, meaning foreign buyers will need less overseas currency to buy the same number of products. So, it is good news for companies selling products abroad.

(!!!) Currency depreciation will decrease imports and increase exports.

Why altering exchange rates is not a good idea? Large unpredictable fluctuations in exchange rates can create threats as business planning becomes very complex. If businesses are not be able to accurately forecast export sales or costs of imported materials due to exchange rate volatility, it makes forecasting impractical. Also, businesses may postpone international trade deals waiting for more favorable movements in the exchange rate (e.g. pay less for importing raw materials from overseas when the home currency appreciates).

2. Set international trade barriers. Free trade means a situation where no restrictions or trade barriers exist which might prevent or limit trade between countries. When free trade agreements exist, the countries are trading without any restrictions.

a.) Protect local producers. Protectionist measures in the form of trade barriers are the actions by the government of one country that prevent or limit free trade with other countries (e.g. tariffs, import quotas, embargoes, etc.) usually to control imports, hence safeguarding the domestic markets.

b.) Strengthen local producers. The government can also try to strengthen local producers against foreign competitors through subsidies – free financial support from the government for local firms to reduce the cost of home producers increasing their competitiveness globally.

Why setting international trade barriers is not a good idea? Any trade restriction will pose a barrier to trade, e.g. home businesses trying to establish themselves in overseas markets, or foreign multi-national businesses investing in our home country.

Summary

Government policies used to achieve these four fundamental goals will therefore present opportunities and threats for businesses. Marketers need to consider the past, current and future state of the economy in the short-term, medium-term and long-term.

It is because the state of the country’s economy can contribute directly to the success or failure of a business. This is especially applicable when it comes to planning for business growth or doing international marketing. If business expansion as an objective is approved right before a long economic recession, then not only the business may not increase its sales, but can also go bankrupt.

In addition to the four government objectives for the economy, consumer attitudes and business confidence levels also affect the level of business activity. The actions and activities of competitors can constrain the performance of a particular business as well. However, the ability to spot and exploit market gaps in a fast-growing economy can lead to high sales, high profits and overall value maximization for shareholders.

Articles: 1,465 · Readers: 752,000 · Views: 2,244,142

Articles: 1,465 · Readers: 752,000 · Views: 2,244,142