The country’s economy usually does not grow at the steady and constant rate, let’s say 5% annually. Instead, economies tend to grow at very, very different rates over time which leads to The Business Cycle.

What is The Business Cycle?

The Business Cycle is the periodic growth and decline of a country’s economy. It is illustrated as regular swings in economic activity that occur in most economies. It shows changes in the level of activity in the economy expressed as short-term fluctuations.

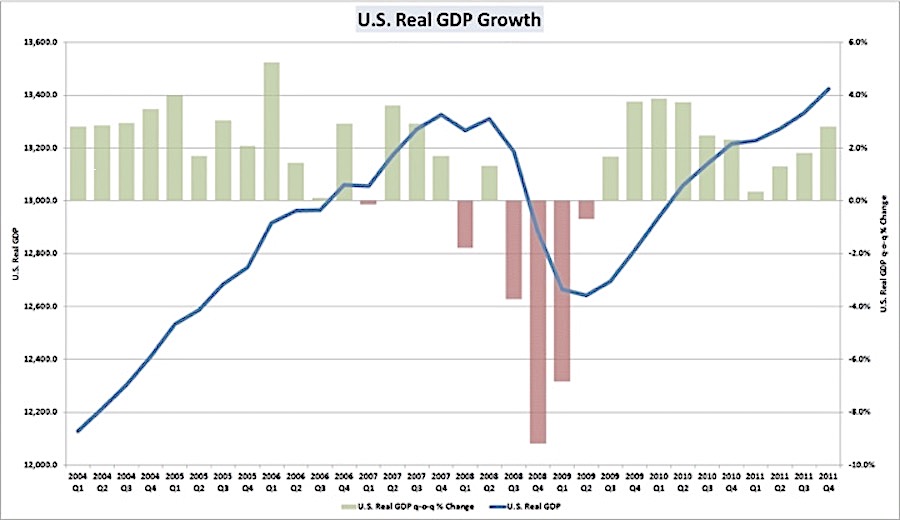

Economic activity in the country is measured by Gross Domestic Product (GDP). The Business Cycle is usually measured by real Gross Domestic Product (GDP) that is adjusted for inflation.

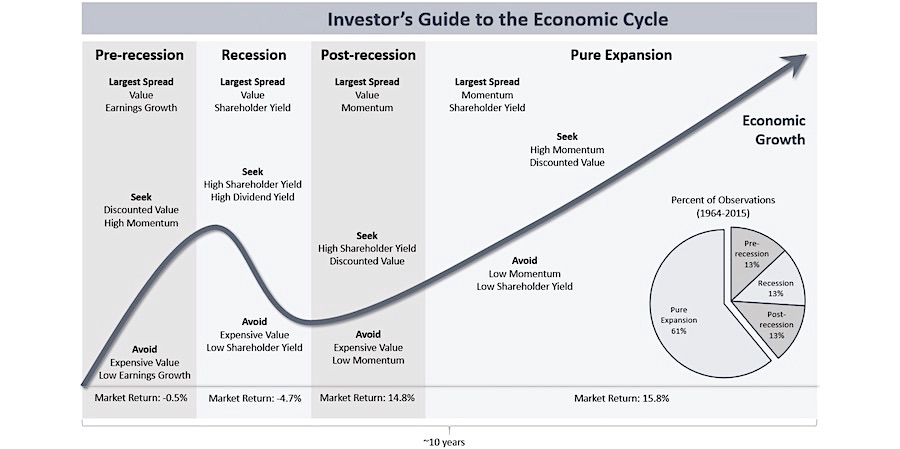

All economies go through the Business Cycle which has five main stages. Each stage can last between a few months and several years or even decades.

Stages of The Business Cycle in details

The stages in the Business Cycle include growth (or expansion), boom (or peak), recession (or contraction), slump (or trough) and recovery. These stages are varying from rapid economic growth to the boom conditions, and then through recession when total national output is declining until it reaches slump to recover again.

1. Growth / Expansion

This stage is when the economy grows. During the growth stage, the level of economic activity is increasing.

Key characteristics of the growth stage are:

- OUTPUT PRODUCED: Production increasing to meet growing demand from customers.

- SALES: Existing businesses sell more products and grow in size.

- WORKER’S WAGES: Raising.

- PROFIT: Businesses make profit as they sell more.

- CONFIDENCE: Stronger as standards of living are raising.

- UNEMPLOYMENT: Falling unemployment because businesses are doing well creating more jobs.

- SPENDING: Consumer spending is increasing.

- PRICES: Companies increase prices due to growing demand.

- IMPORTS: Imports from abroad are increasing.

- START-UPS: A very positive outlook for new businesses.

- NEW INVESTMENTS: Investments are increasing.

- INVENTORY: Companies stockpile more inventories to fulfill strong demand.

WHAT’S NEXT? The growth stage will last until it reaches boom when the levels of growth are at the maximum.

2. Boom / Peak

This stage is when economic growth is very fast. During the boom stage, the level of economic activity is at its highest level.

Key characteristics of the boom stage are:

- OUTPUT PRODUCED: Most sectors of the economy are performing at their best. Therefore, levels of production are at the highest.

- SALES: Very high levels of demand for goods and services.

- WORKER’S WAGES: Raising fast along with shortage of skilled people.

- PROFIT: Profits are the highest as sales and prices are at the highest levels.

- CONFIDENCE: Consumer confidence is very high resulting from higher incomes and robust employment opportunities. Business confidence levels are also high resulting from very high profits.

- UNEMPLOYMENT: Unemployment is at the lowest – the closest ever to 0%. Many people have better jobs to choose from.

- SPENDING: Strong spending from both businesses and individuals.

- PRICES: Rising above average causing demand-pull inflation.

- IMPORTS: Rising above the average.

- START-UPS: Many new companies and only few closures.

- NEW INVESTMENTS: Business investments are the highest levels.

- INVENTORY: High or very high.

WHAT’S NEXT? What goes up, must go down people say. Inflation will rise because of very high demand for goods and services (demand-pull inflation), and shortages of workers will lead to higher wages, therefore higher costs (cost-push inflation). The country’s central will likely increases interest rates to reduce inflationary pressure. A downturn often results from this. High inflation will both make products uncompetitive as demand will decrease and higher costs will make profits to start declining. If the economic outlook looks poor due to low demand, the economy may go into a decline.

3. Recession / Contraction

WHY? Recession is the effect of falling demand and when higher interest rates start to take effect.

This stage is when the economy is shrinking in size. During the contraction stage, the level of economic activity starts to slow down and may even start to fall. A recession occurs when the fall lasts for at least two consecutive quarters (at least six months).

Key characteristics of the recession stage are:

- OUTPUT PRODUCED: Falling demand from consumers leads to lower levels of production.

- SALES: Many businesses suffer from lower sales, especially those with a small range of products, or selling products that are sensitive to changes in income, e.g. expensive houses, high-end cars, luxurious jewelry or overseas holidays.

- WORKER’S WAGES: Incomes and consumer demand fall. Some workers are being made redundant.

- PROFIT: Profits are much reduced due to lower sales.

- CONFIDENCE: Business confidence falls.

- UNEMPLOYMENT: Unemployment increases as businesses are not doing well and have to cut costs.

- SPENDING: Falling demand from customers will significantly reduce spending.

- PRICES: Price increases slow down, or there are none.

- IMPORTS: Falling due to decreasing demand.

- START-UPS: Many start-ups record losses, and closures increase as some firms go out of business.

- NEW INVESTMENTS: Less and less investment in existing businesses.

- INVENTORY: Falling too due to lower demand.

WHAT’S NEXT? A decline in economic activity will last until it reaches slump when the levels of growth are at the minimum.

4. Slump / Trough

WHY? Slum will occur, if the government fails to take corrective economic action. Hopefully, most governments these days take the necessary actions in time to prevent the downturn becoming a serious slump.

This is the last stage of decline in the business cycle – the bottom of a recession.

This stage is when the real GDP falls substantially. During the slump stage, the level of economic activity is at its worst.

Key characteristics of the slump stage are:

- OUTPUT PRODUCED: Low or very low production of goods and services.

- SALES: Low or very low demand for products.

- WORKER’S WAGES: Little or no raise. Workers suffer lack of job security or even job losses.

- PROFIT: No profit or even serious loses. Many businesses suffer from poor cash flow and many will have already closed down due to insufficient money to run the business on daily basis.

- CONFIDENCE: Very low business confidence. Consumers have little confidence in the economy too.

- UNEMPLOYMENT: High unemployment due to low overall business activity.

- SPENDING: Low or very low levels of consumer spending.

- PRICES: Fixed Asset prices fall. Product prices may start to fall, remain stable or rise way below average.

- IMPORTS: Low or very low.

- START-UPS: Only few new start-ups while many businesses close down.

- NEW INVESTMENTS: Very little investment in existing businesses.

- INVENTORY: Low or very low.

WHAT’S NEXT? All downturns eventually lead to a recovery.

5. Recovery

WHY? This is either because corrective government action starts to take effect, or the rate of inflation falls, so that the country’s products become competitive once more and demand for them starts to increase.

This stage is when the economy starts to rise again after a slump. During the recovery stage, the level of economic activity is slowly increasing.

Key characteristics of the recovery stage are:

- OUTPUT PRODUCED: Raising slowly to fulfill growing demand.

- SALES: Raising as customers start purchasing products again.

- WORKER’S WAGES: Wages for the workers may rise.

- PROFIT: With growing sales revenue profits will start to grow as well.

- CONFIDENCE: Customer confidence will begin to rise.

- UNEMPLOYMENT: Falling unemployment due to recovering business activity.

- SPENDING: Customer spending will begin to raise.

- PRICES: Some companies may start to increase prices.

- IMPORTS: Demand for imports may rise.

- START-UPS: More new companies due to more opportunities for businesses.

- NEW INVESTMENTS: Companies will slowly start investing more.

- INVENTORY: The level of inventory held by businesses will gradually raise.

Final words about The Business Cycle

The economy of any country is highly unlikely to grow at the same rate over a long period of time because there will be changes in the economic activity. The economy will grow and shrink over a number of years or decades going through The Business Cycle.

The governments usually try to manage business cycles by heavy government spending, raising or lowering TAXes for individuals and businesses, and adjusting interest rates. Therefore, it is crucial for governments to make appropriate economic policies to steer the economic growth in the right direction.

Articles: 1,590 · Readers: 764,000 · Views: 2,278,118

Articles: 1,590 · Readers: 764,000 · Views: 2,278,118