This article identifies situations where the market system can fail from provision of demerit goods and merit goods, so government interventions might be necessary. Specifically, regulation, property rights, permits and TAXation, as well as government provision of public goods and subsidies.

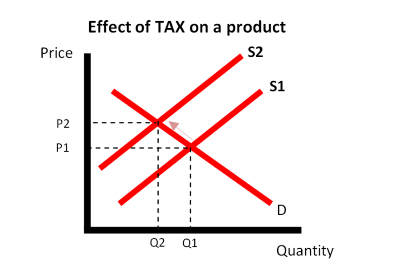

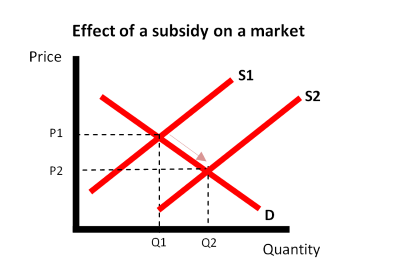

It explains with a neat accurate diagram, how the use of subsidies and Indirect TAX will affect the market. It also analyzes how to deal with lack of competition and consequences of idle resources.

Government interventions to externalities

The details below are all potential causes and government solutions to externalities. For more information about externalities, please see the article EXTERNALITIES.

A. Government interventions in demerit goods

Governments believe that demerit goods are over-provided by the market system. They feel this way because demerit goods are bad for society. Demerit goods are often highly desired by consumers. Goods like cigarettes, alcohol, drugs and guns are fun, addictive, exciting and can provide pleasure for many. Therefore, there is a market for such goods, which in turn means firms are willing and able to provide them as there is a great deal of profit to be made.

Demerit goods cause negative externalities, which is to say the negative effects on society are significant.

For example, over consumption of alcohol leads to work days being lost as people are sick, unable to work as well as before or even die early due to severe problems such as liver failure. Alcohol may also cause violent behaviour in public and the home, not to mention others may drive under the influence of alcohol. These issues may cause injury and possibly deaths which are socially undesirable. People being unable to work due to alcohol or alcohol related incidents has a detrimental effect on the economy as it wastes resources, due to labour not working, dying before retirement and resources being used for health care that could have been used for other things or to treat other illnesses.

As stated above, demerit goods cause negative externalities. The effects of negative externalities can be reduced or prevented with the policies discussed below. These policies are regulation, property rights, permits and TAXation.

a. Regulation

Governments can limit or ban products or services they feel create negative externalities. Factories in the EU are restricted as to how much carbon dioxide emissions they release. Coal fires must use smokeless coal and cars must use unleaded petrol.

It is considered to be cheap and easy for governments to enforce such rules and policies. Though some consumers and firms may not agree, regulations are often relatively easy to understand.

The disadvantages are that the regulation may be too soft or hard, the regulation should be at the level where the benefit equals the cost. For instance, if banning smoking in pubs in the US costs the industry USD$2.5 million, but savings to the health service are USD$2 million, this suggests the regulation is too hard. The pub industry is suffering more than the benefit created by the policy.

An additional problem is that regulations do not consider individual circumstances, e.g. some pubs have outdoor areas and others do not. Those without would naturally be hit harder by the regulation than other pubs.

b. Property rights

The government can give people the right to protect their property and maintain the environment at the same time. This is done by allowing people to seek compensation if their property has been damaged.

Give property rights to a water company to sue others for polluting rivers.

A homeowner has property next to a scenic spot; a company developing on that place will destroy the natural beauty of the area and reduce the value of the property. Property rights can give the owner the ability to fight against the development or perhaps gain compensation from the company initiating the development.

The benefits of this policy are that it internalizes the problem so the only people involved are those who need to be, such as the developer and the homeowner. The owner or another private economic agent is more likely to have superior knowledge about the value of property in comparison to others (such as the government). Another benefit is that resources move from the creator of the externality directly to the victim.

Problems, however, include the inability to give some property rights. If you have lung cancer because of passive smoking, do you sue every smoker you have ever come into contact with? This would be impossible. What about farmers who have crops damaged by acid rain from a factory in another country?

It may be impossible to give property rights if the problem is external to the economy. However if governments co-operate these problems can be resolved. Deforestation in China was causing sandstorms to hit neighboring nations South Korea and Japan. The governments of those two countries gave aid to China to plant more trees, providing social benefits for all three nations.

c. Permits

Governments can issue permits (a license) to allow a social cost to take place.

A parking permit gives someone the right to drive into the city and pollute. If you do not have a permit, you cannot park there. These permits increase the cost of an activity so increase the desire to avoid creating externalities. These permits are also tradable; if you do not use your permit another can buy it from you. This will encourage companies to reduce pollution levels in order to be able to sell ‘extra’ permits.

Permits could exist for the release of carbon dioxide emissions; if a company has purchased permits from the government that they do not need, they can sell them on to another company.

d. TAXes

Governments can set a TAX on products or services that create negative externalities.

This will add to costs and discourage their production and consumption. The producer of the product is responsible to pay the TAX directly to the government. This will affect the market as in the diagram below. Higher TAX means less supply, so higher price.

B. Government interventions in merit goods

Merit goods are those which governments believe to be under-provided by the market system. They feel this way because they are good for society and create positive externalities. Most consumers do not consume enough merit goods, because we are bad at planning for using them or we simply do not want to pay too much for them. Examples of merit goods include education, health care, pensions and insurance.

Using education as an example, it creates social benefits because a highly educated national workforce will have more skills and abilities than one which is not educated. Therefore the country can be more productive, allowing the economy to grow which will improve the standard of living of all.

Even though education is good for society the market system would not provide for all, so it falls to the government to provide it directly by themselves, or they may offer subsidies for firms.

a. Subsidy

A subsidy means the government gives funding to organizations. This in turn lowers the costs of production so that producers in the market are willing and able to supply more. This is shown in the diagram below. More subsidies means more supply, so lower price.

Subsidies have an opportunity cost as the government is using TX money that could be used on other things. However, if all are able to consume merit goods most governments will accept that resources have been allocated in the best way.

b. Government provision of public goods

Public goods are goods which produce benefits that no one can be excluded from. Therefore no consumer is willing to pay, for example, street lights.

As no consumer would be willing to pay, no firm would be willing to provide the good or service.

If no public goods such as street lights or a police force are provided, market failure will occur. In order to prevent this type of market failure, the government must provide pubic goods.

How to deal with lack of competition?

A monopoly (one powerful or dominant company) could cause resources to be used less efficiently.

Without competition there is less pressure to produce superior products or services because no-one else can beat you. Governments often dislike private monopolies as they feel resources are being wasted, prices are too high and the firm is not innovative enough.

To combat this, some governments ‘break up’ monopolies into several different companies to create competition and inject innovation, quality and lower prices into a stagnant industry.

An alternative is that governments can provide the product or service themselves at an affordable price, though government-run industries often suffer from inefficiency and are rarely innovative.

Consequences of idle resources

Market failure can also occur when factors of production (land, labor and capital) stand idle which means are not used.

For example, if there is high unemployment, it can be said that there is market failure as many people are willing to work but are unable to do so.

This leads to an inefficient economy and is socially undesirable to all with a stake in the economy.

Summary of government interventions

Market failure is when the market system fails to allocate resources in a manner that is socially desirable.

Demerit goods are socially undesirable, so TAXes, permits, property rights and regulations may be used to limit quantities.

On the other hand, merit goods are socially desirable, thus subsidies may be given or the government actively provides them by themselves in order to increase the quantities that are available and consumed.

Articles: 1,400 · Readers: 740,000 · Views: 2,209,961

Articles: 1,400 · Readers: 740,000 · Views: 2,209,961