This article is about different types of costs in a business. Let’s consider costs when producing one type of product and many types of products.

A. Producing one type of product

These financial costs are incurred in making a single good or providing a single service. These costs are linked to the level of the business’s output and they will be somehow affected by the level of output.

The categories of costs when producing one single product are:

- Fixed Costs (FC)

- Variable Costs (VC)

- Semi-Variable Costs (SVC)

- Total Costs (TC)

- Average Cost (AC)

- Marginal Cost

All these costs are considered as the costs undertaken in the production process. Let’s think about the production process as running a fast-food restaurant and serving beef hamburgers.

1. Fixed Costs (FC)

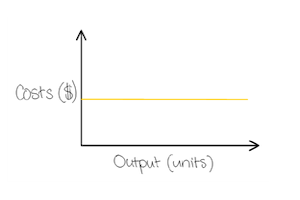

Fixed Costs (FC) do not change with output. They remain unchanged no matter what the level of production is. Therefore, Fixed Costs (FC) must be paid regardless of how much the business produces and sells, even if there is no Output. Fixed Costs (FC) will be the same amount when Output is zero, or when the firm is producing its maximum output.

Fixed Costs (FC) can change within one year. But, this happens independently from the level of output. For example, a landlord might raise rent due to higher property prices in the economy. Company directors may ask for being paid higher salaries due to rising cost of living. Or, interest rates in the country increase causing higher interest to be paid on bank loans that the business has. In all of those cases, Fixed Costs (FC) increase but are not directly linked to the firm’s production levels.

Examples of Fixed Costs (FC)

- Rent. This may include factory rent. Or, rent of leased premises such as a restaurant where beef hamburgers will be served.

- Salary. Annual salary for managers paid in equal payments on monthly basis. The manager of the restaurant will be paid salary for his work.

- Interest. Fixed interest payments on a bank loan to be paid every month.

What Fixed Costs (FC) look like on the graph?

Graph 1: The graph shows the business’s Fixed Costs (FC). Source: https://brackensibbusiness/finance/

2. Variable Costs (VC)

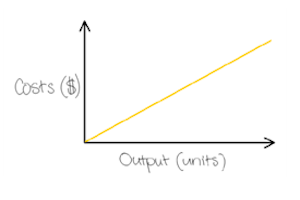

Variable Costs (VC) change with the level of output produced. They change in direct proportion to the level of output meaning that if the level of output triples, then Variable Costs (VC) would also triple.

When the business has Variable Costs (VC) of USD$10,000 for producing 1,000 units of output, as output increases, so too do Variable Costs (VC). Variable Costs (VC) of producing 2,000 units will now be USD$20,000.

Examples of Variable Costs (VC)

- Raw materials. For a restaurant business, raw materials will include beef patty, bums of bread, vegetables, cheese, etc. Raw material costs will increase, if the restaurant makes more hamburgers.

- Wages. Other examples are the labour costs incurred to produce those hamburgers such as wages for workers including a chef cooking those burgers as well as the waiters taking orders and serving the customers.

- Packaging. Packaging such as wrappers and boxes for hamburgers.

- Transportation. Transportation to each individual customer via shipping companies.

What Variable Costs (VC) look like on the graph?

Graph 2: The graph shows the business’s Variable Costs (VC). Source: https://brackensibbusiness/finance/

In theory, if there is no production then the value of Variable Costs (VC) should be zero. However, this is not always true. Hence, Semi-Variable Costs (SVC) also exist.

3. Semi-Variable Costs (SVC)

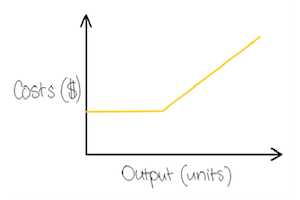

In reality, many costs are classified as Semi-Variable Costs (SVC) which include an element of both Fixed Costs (FC) and Variable Costs (VC). Semi-Variable Costs (SVC) are fixed at the beginning before reaching a certain level of output. Only after crossing that level, they tend to change and become variable.

Examples of Semi-Variable Costs (SVC)

- Electricity fee. Electricity fee is usually charged as standing flat charge plus the cost per unit of electricity used.

- Telephone & Internet fees. Telephone & Internet fees allow subscribers to have a predetermined number of ‘free minutes’ as there is a fixed minimum monthly charge. It means that no matter how much the person uses the phone or Internet, there is a fixed minimum monthly charge anyway. Only after the user exceeds the available quota, then the bills become variable.

- Compensation of salespeople. The payment to salespeople is not necessarily always straightforward. Sales agents tend to earn modest fixed basic monthly salary plus a hefty commission that varies with sales.

- Maintenance costs. Machinery and vehicles are usually classified as fixed because they need to be regularly checked and serviced at least once a year. But, the more they are used due to producing more products, the higher their variable maintenance costs tend to be.

What Semi-Variable Costs (SVC) look like on the graph?

Graph 3: The graph shows the business’s Semi-Variable Costs (SVC). Source: https://brackensibbusiness/finance/

4. Total Costs (TC)

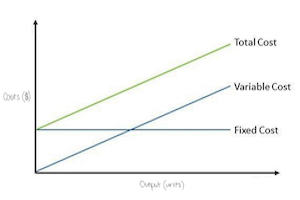

Total Costs (TC) are all the costs of producing a certain level of output.

How to calculate Total Costs (TC)?

In general, Total Costs (TC) include all Fixed Costs (FC) and all Variable Costs (VC) of production incurred by the business:

Total Costs (TC) = Total Fixed Costs (TFC) + Total Variable Costs (TVC)

Specifically, Total Fixed Costs (TVC) are the sum of all Fixed Costs (FC) incurred by the business including rent, salaries and interest.

And, Total Variable Costs (TVC) are calculated multiplying all Output produced by Average Variable Cost (AVC) of each unit produced:

Total Variable Costs (TVC) = Average Variable Cost (AVC) x Output

For producing 2,000 units of output, if Total Fixed Costs (TFC) are USD$5,000 and Total Variable Costs (TVC) are USD$7,000, then Total Costs (TC) will be $13,000.

What Total Costs (TC) look like on the graph?

On the graph, Fixed Costs (FC) do not start from zero, whereas Variable Costs (VC) do. This means that Total Costs (TC) will not start from zero either. The Total Costs (TC) line starts at the same value as Total Fixed Costs (TFC). It is because Fixed Costs (FC) have to be paid, even if there is no output.

Graph 4: The graph shows the business’s Total Costs (TC). Source: https://the-pen.co/

5. Average Cost (AC)

This is Average Cost (AC) of producing each unit of output. Another name is unit cost, or cost per unit. It shows the amount of money that the business has to spend in order to produce each one unit of output, for example one hamburger.

Clearly, calculating Average Cost (AC) is an essential step towards pricing one single product. First, we need to know how much it costs on average to produce one unit of output, and only then we can think about what prices to charge, for example how much one hamburger should cost.

How to calculate Average Cost (AC)?

Average Cost (AC) of producing a product is calculated by dividing Total Costs (TC) of production by Output, the total number of units produced:

Average Cost (AC) = Total Costs (TC) / Q

Or, to be more specific:

Average Cost (AC) = [Total Fixed Costs (TFC) + Total Variable Costs (TVC)] / Q

If a firm produces 2,000 hamburgers at Total Costs (TC) of USD$13,000, then Average Cost (AC) of producing one hamburger is USD$6.5 (USD$13,000 divided by 2,000).

6. Marginal Cost

Marginal Cost is the additional cost of producing one more unit of output. For example, producing one more beef hamburger at the restaurant. Marginal Cost will be all those extra Variable Costs (VC) to make that extra unit – additional raw materials and additional labour to be more specific.

So, Marginal Cost involved in making one more beef hamburger are the additional costs of raw materials (e.g. a single beef patty, one bum of bread, a portion of vegetables, one slice of cheese, etc.) and the labour costs incurred to produce that one hamburger.

How to calculate Marginal Cost?

A firm produces 2,000 hamburgers.

Total Fixed Costs (TFC) of producing 2,000 units of output is USD$5,000. Total Variable Costs (TVC) of producing 2,000 units is USD$7,000. Average Variable Cost (AVC) is USD$3.5. So, Total Costs (TC) of producing 2,000 hamburgers is USD$13,000. And Average Cost (AC) of producing one hamburger is USD$6.5.

In order to calculate Marginal Cost, we should first calculate Total Variable Costs (TVC) of producing 2,001 hamburgers. To do so, we multiply 2,001 by Average Variable Cost (AVC) of USD$3.5 which is USD$7,003.5. And then we add Total Fixed Costs (TFC) of producing 2,001 units of output which is unchanged USD$5,000. So, Total Costs (TC) of producing 2,001 hamburgers is USD$13,003.5.

We know that Total Costs (TC) of producing 2,000 hamburgers was USD$13,000. So, in order to produce one more hamburger above the original level of output of 2,000, we need to add USD$3.5. This is our Marginal Cost. So, in this case, Average Variable Cost (AVC) equals to Marginal Cost.

In order to calculate Marginal Cost, we can also use this formula:

Marginal Cost = Change in Total Costs (TC) / Change in Quantity

Marginal Cost is calculated by taking the change in Total Costs (TC) of producing more goods, and dividing that by the change in Output, the number of goods produced.

B. Producing many types of products

When the business is producing more than one good or provides more than one service, business managers will usually use a different method of classifying costs.

This costing method will look at the allocation of costs into each product produced. It is because different products will have different Direct Costs.

The categories of costs when considering the allocation classification include:

- Direct Costs

- Indirect Cost (Overheads)

1. Direct Costs

Direct Costs are the costs that can be clearly identified with each unit of production, and can be allocated to a Cost Center. They are specifically related to an individual project or the output of a particular product without which the costs would not be incurred.

Essentially, Direct Costs can be traced back to the output of a specific type of product and to a specific Cost Center.

Examples of Direct Costs

There are usually two most common Direct Costs including:

- The cost of raw materials. One of the Direct Costs of a beef hamburger in a fast-food restaurant is the cost of ingredients such as beef patty, bums of bread, vegetables, cheese, etc. The Direct Costs of a hot dog in that same fast-food restaurant is also the cost of different ingredients such sausages instead of beef. Different products will require different ingredients to prepare them.

- The cost of labor. The labor cost in the hamburger restaurant will include wages for a chef cooking those hamburgers as well as the waiters taking orders and serving the customers. This cost of labor can be allocated according to how much times the chef spends on preparing hamburgers and how much times he spends preparing hot dogs, pizzas sandwiches. Different products will require different amount of labor to prepare them.

Direct Costs are related to different types of products, but they cannot be necessarily related to the level of output of each product. However, Direct Costs can be seen as variable costs as they will be different for different products at different times of the year.

2. Indirect Costs (Overheads)

Indirect Costs are often referred to as Overheads. These are the costs that cannot be identified with a unit of production or allocated accurately to a Cost Center. They cannot be clearly traced to the production or sale of any single product. In fact, they apply to running the whole business.

Examples of Indirect Costs (Overheads)

Indirect Costs (Overheads) are usually classified into four main groups:

- Production Costs. These include rent of factory and leasing of equipment. Also, costs of utilities such as electricity, water and gas can be associated with the whole business rather than being directly linked to the output of a particular product, or any specific department.

- Sales & Marketing Costs. These include Research and Development (R&D) of products, promotion, selling and distribution. Also, compensation of the sales staff.

- Administration Costs. These include rent of office space. Also, salaries for administrative staff and executives, legal expenses, insurance, security, stationery, postage costs, accounting fees, etc. Another indirect cost of running a business organization is the cost of cleaning the premises.

- Finance Costs. These include interest on bank loans, interest on overdraft, coupons on bonds, etc.

Indirect Costs can be seen as fixed costs because they can be the same every month or even every year. But, they cannot be identified with a particular business activity since they do not directly relate to the level of output of any specific product.

Articles: 1,512 · Readers: 757,000 · Views: 2,260,160

Articles: 1,512 · Readers: 757,000 · Views: 2,260,160