This article is about the definition of Aggregate Demand (AD), the Aggregate Demand (AD) curve and shifts in the Aggregate Demand (AD) curve. You will find out here how to define Aggregate Demand (AD), explain what causes the Aggregate Demand (AD) to shift and draw the Aggregate Demand (AD) curves to illustrate shifts in the economy.

Definition of Aggregate Demand (AD)

Aggregate Demand (AD) refers to total demand for goods and services within an economy and can be shown as a curve showing the relationship between the price level and the level of real expenditure in the economy.

The price level is the average price in the economy. An increase in the price level is known as inflation. Real Output (O) is equal to Real Expenditure (E) and Real Income (Y). The values of these three components are identical (O = E = Y).

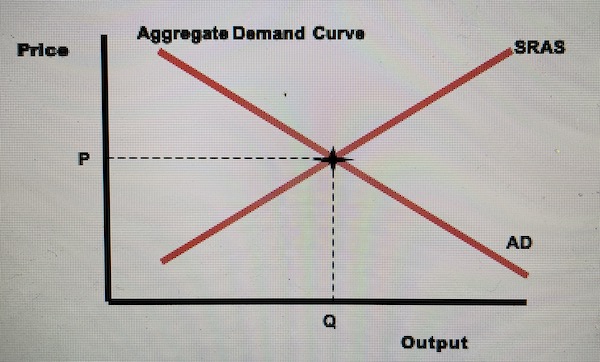

Chart of Aggregate Demand (AD)

The Aggregate Demand AD curve is the graphical representation of the relationship between the GDP of goods and services at specific price levels. The Aggregate supply (AS) Curve is the graphical representation between supply of goods and services produced within an economy at a given time.

Components of Aggregate Demand (AD)

Aggregate Demand (AD) includes demand from consumers, private business and net income from overseas.

Aggregate Demand (AD) is calculated with the following equation:

Aggregate Demand (AD) = C + I + G + (X – M)

Or:

Aggregate Demand (AD) = Consumption + Investments + Government Spending + (Exports – Imports)

Where:

C = Consumption (Consumer Expenditure)

Households’ expenditure on goods, both durable and non-durable, and services. The amount of consumer expenditure is affected by consumer confidence and the level of personal wealth.

I = Investment

Spending by companies on capital goods such as machinery, new buildings, etc. Investment also includes spending on ’working capital’ such as stocks of finished goods and work in progress. This is money used for the day-to-day operation of a business calculated as Current Assets minus Current Liabilities.

Investment is affected by expected rates of return, business confidence in markets and level of demand from consumers. Interest rates also have an impact on the level of investment – high rates mean the cost of borrowing is higher, so the demand for loans will fall and vice versa.

G = Government Spending

Government spending includes money spent on publicly provided goods including merit goods and public goods. A merit good is a good that is underprovided in the market and causes positive externalities, for example, health care, education or public transport. A public good is provided to all at the same time, and no one can be excluded from using it, for example, street lighting, the police force or fire brigade.

Some governments, such as the UK, provide welfare for the unemployed or retired in the form of job seekers allowance and state pensions. These are not included in government expenditure because they do not contribute to output.

Government spending is affected by political policies of the ruling party and the current phase of the business cycle. For example, a recession may increase government spending in an attempt to generate demand and stimulate confidence in the economy. Another potential example could be structural needs, i.e. transport networks may not be strong enough causing the government to invest money into new motorways or railway lines. The Expo Shanghai 2010 followed massive investment in China’s new high-speed rail service.

X = Exports and M = Imports

Exports are goods and services sold to overseas markets. They are an injection into the economy and cause output to increase. On the other hand, imports are goods and services purchased from foreign markets by domestic consumers, business and also the government.

Goods include manufactured products such as cars and TVs, and perishable goods, such as foodstuffs. Services include financial services such as banking and insurance. Lower prices are beneficial for an economy as it makes the country more competitive. If an economy’s prices fall, goods and services are also cheaper for foreign buyers. When export sales increase, the additional injections will add to aggregate demand, leading to increased output.

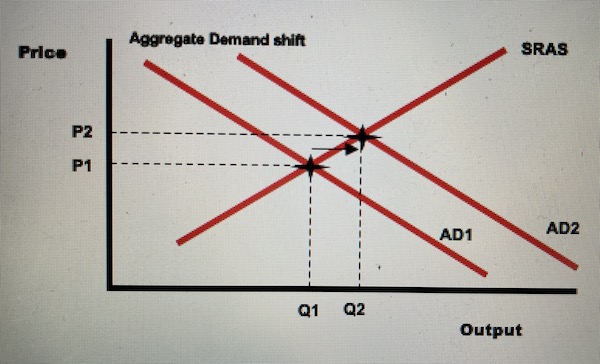

Shifts in the Aggregate Demand (AD) curve

Movement along the curve occurs because there has been a change in price. Shifts in demand can occur, if there is a change to one of the following variables: Consumption, Investment, Government Spending, Exports and Imports.

What causes shifts in the Aggregate Demand (AD) curve?

(C) – Consumption (Consumer Expenditure)

Shifts in consumption can occur if:

- Unemployment levels change; lower unemployment increases income and allows greater spending in the economy and vice versa;

- Interest rates fall, easing borrowing and deterring saving;

- Booms in the stock market will encouraged people to invest;

- New products or technology;

- Decreasing TAXation, especially income TAX increases disposable income.

(I) – Investment

Rising investment may occur because:

- Confidence is increased perhaps due to government investment;

- Falling interest rates decrease the cost of borrowing, so companies can afford to invest larger amounts with less risk;

- Companies have become more profitable, reduced TAX, more efficient from new technology, etc.;

- Decreases in TAXation.

(G) – Government Spending

An increase in government spending will shift the Average Demand (AD) curve outward. Such spending may be the result of:

- Change of government or government policy;

- Investment to pull an economy out of recession.

(E) – Exports and (M) – Imports

Exports are all the goods and services sold to consumers and business in other countries. Imports are all the goods and services purchased from businesses in other countries.

- Exports: if prices fall, domestic goods become more competitive, so there will be a shift to the right as demand increases output;

- Imports: vice versa;

- A fall in the exchange rate makes Exports more competitive and Imports less competitive;

- An improvement in the quality of domestically produced goods will increase demand for Exports.

Summary

In short, Aggregate Demand (AD) is a measure of total output in an industry. It considers all those who contribute towards it such as consumers, investors, government and foreign buyers.

Articles: 1,465 · Readers: 752,000 · Views: 2,244,142

Articles: 1,465 · Readers: 752,000 · Views: 2,244,142