This article defines investment and answers the question why businesses invest. It explains the determinants of investment and the difference between gross and net investment.

It introduces the concepts of Marginal Efficiency of Capital (MEC) and the accelerator theory.

What is investment?

Investment means adding to the capital stock of the economy. This simply means the purchasing of machines, building offices and anything else purchased for the intention of producing goods and services for the economy.

Investment can be segmented into groups:

- Physical Investment. Investment in physical capital which is the purchase of inanimate objects, materials, building and capital goods.

- Non-physical Investment. Investment in human capital which is investment in labor such as training and education schemes.

Why a business invests?

There are many reasons why businesses invest. Naturally, they do so with the intention of receiving a return on that investment, or Return on Investment (ROI), i.e. making more money than they spend.

Yet, there are many particular reasons for investment including:

- Replace depreciated capital goods.

- Improve technology to increase production efficiency.

- Develop new economies of scale or increase current economies of scale.

- Increase market share.

- Expand the business’s product portfolio.

- Enter into a new market.

- Increase output in order to better meet increased demand.

Net Investment and Gross Investment

Economists use the expressions net and gross regarding investment levels within an economy.

1. Gross Investment is a measure of total investment.

2. Net Investment is a measure of total investment minus depreciation.

The difference between the two terms is due to depreciation. Depreciation means a decrease in the value of capital goods from the passage of time and everyday wear and tear. All goods are worn out by their use after some time, and therefore must be replaced.

Marginal Efficiency of Capital (MEC)

Firms invest in order to make a profit which is termed a Return on Investment (ROI). The rate on an investment in economic terms is Marginal Efficiency of Capital (MEC).

The amount of investment in an economy depends very heavily on the interest rate set by central banks. Firms will typically invest in projects that yield a higher rate of return than the interest rate.

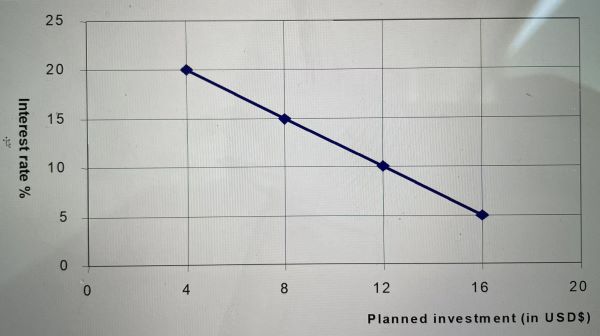

The diagram below shows this relationship.

An increase in interest rates will lead to a decrease in investment. For example, if interest rates are 10% and the Marginal Efficiency of Capital (MEC) is 5%, it is more beneficial for the business to save the money instead of investing it in the project.

A decrease in interest rates will lead to an increase in investment. For example, if interest rates are 5% and the Marginal Efficiency of Capital (MEC) is 10%, it is more beneficial for the business to save the money instead of investing it in the project.

The higher the interest rate or lower the Marginal Efficiency of Capital (MEC), the greater the opportunity cost of investing. The lower the interest rate or higher the Marginal Efficiency of Capital (MEC), the lower the opportunity cost of investing.

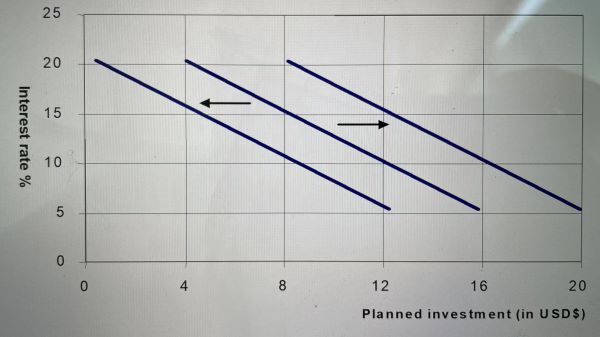

Planned investment and shifts

In a similar way to the supply and the demand curves, the amount of planned investment in relation to interest rates can also shift.

The shifts of the Marginal Efficiency of Capital (MEC) curve depend on several variables such as:

- Cost of capital goods

- Technological change

- Expectations

- Government policy

Inward shift is shift of the Marginal Efficiency of Capital (MEC) to the left. And, outward shift is shift of the Marginal Efficiency of Capital (MEC) to the right.

1. Cost of capital goods

If the cost of capital goods rises, then the rate of return from investment will fall, leading to a reduction in planned investment. This will result in the inward shift of the Marginal Efficiency of Capital (MEC). In some instances rising costs are not a problem. If the price increases are in line with inflation (the same rate of growth as inflation), it may be easy to pass on the additional cost to the customer.

If the cost of capital goods declines, then the rate of return from investment will grow, leading to an increase in planned investment. This will result in the outward shift of the Marginal Efficiency of Capital (MEC).

2. Technological change

Improvements in technology allow for faster and less wasteful production processes. This encourages firms to upgrade their factories and offices leading to an increase in planned investment, or an outward shift the Marginal Efficiency of Capital (MEC).

Any deterioration or downgrades in technology will allow for slower and more wasteful production processes. This discourages firms to upgrade their factories and offices leading to a decrease in planned investment, or an inward shift the Marginal Efficiency of Capital (MEC).

3. Expectations

Managers base their estimates of the rate of return partly on their expectations of the future.

Like consumers, a positive view of the future will increase investment causing outward shift.

Conversely, a negative view of the future will logically cause a decrease in the level of investment and inward shift.

4. Government policy

Governments make decisions which affect the business environment that ultimately have an effect on the willingness of firms to invest. Government policy that is helpful to businesses will cause an outward shift and increases in investment levels. This could include subsidies, reductions in TAXes, so called TAX cuts, or TAX breaks which means that firms do not need to pay any TAXes.

On another hand, governments can also cause inward shifts and decreases in investment levels, perhaps when they wish to deter foreign investment or by allowing higher consumption demerit goods such as alcohol and tobacco.

The Accelerator Theory

The Accelerator Theory suggests that a planned investment depends on the rate of change in real income:

- If real income is growing, then demand levels will increase, so firms need more capital equipment, and so investment increases. Simply put, periods of rapid economic growth will see investment levels grow quickly – accelerate.

- If real income decreases, then firms existing capital is sufficient for their needs. In periods where the economy is slowing down, investment levels will decrease quickly – decelerate.

Summary about investment

Investment within an economy mainly means buying capital goods to produce goods and services. Many variables affecting investment are external including government policy, level of interest rates, cost of capital and expectations.