There is a number of different methods accountants can use to calculate depreciation of Fixed Assets in Balance Sheet.

Among them, there are two main methods of calculating depreciation that are widely used by accountants around the world:

- Straight-Line Method

- Reducing Balance Method

The annual depreciation is calculated using three key variables:

- Purchase cost of the asset.

- Expected lifespan of the asset. How long it is intended to be used before it needs to be replaced?

- Residual value of the asset. How much it is worth at the end of its useful life?

Let’s take a closer look at how depreciation is calculated.

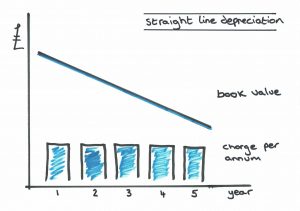

1. Straight-Line Method

Straight-Line Method of Depreciation is the simplest and most commonly used of the two methods; popular amongst European companies.

This method depreciates the value of an asset by a predetermined amount for the duration of its useful life – reduces the value of an asset by the same amount each year.

Source: https://financeinterim.co.uk/depreciation-rate-straight-line-or-reducing-balance

The Net Book Value of the asset is calculated by deducting the accumulated depreciation from the historic cost, the purchase cost of the asset.

Net Book Value = Purchase Cost of the Asset – Depreciation

The following formulae are used to calculate depreciation using Straight-Line Method.

Scenario A: The asset has no residual value at the end of its life.

The following formula is used:

Depreciation = Purchase Cost of The Asset / Expected Lifespan of The Asset (in years)

Example 1: New computers were bought for USD$50,000 and are expected to last ten years, when they will be replaced. The annual depreciation is a fixed amount of USD$5,000 per year. The Net Book Value at the end of each year and at the end of the expected lifespan of the asset is shown below:

Year

0

1

2

3

4

5

6

7

8

9

10

Depreciation

$0

$5,000

$5,000

$5,000

$5,000

$5,000

$5,000

$5,000

$5,000

$5,000

$5,000

Net Book Value

$50,000

$45,000

$40,000

$35,000

$30,000

$25,000

$20,000

$15,000

$10,000

$5,000

$0

Scenario B: The asset has some residual value at the end of its life.

The residual value is an estimate of the scrap or disposal value of the asset at the end of its useful life. Many firms simply use a zero-residual value since estimates may prove to be inaccurate. However, it is unusual for a Fixed Asset to lose all of its value because it can fetch a minimal price when sold.

The following formula is used:

Depreciation = (Purchase Cost of The Asset – Residual Value of The Asset) / Expected Lifespan of The Asset (in years)

The formula given above is then used to calculate the annual depreciation charge.

Example 2: New computers were bought for USD$50,000 and are expected to last ten years, when they will be replaced. After ten years, the computers are expected fetch a second-hand value of USD$10,000. Then, the annual amount of depreciation is worked out as USD$4,000 per annum. There is a difference of USD$1,000 each year compared with the depreciation charge, if there is no residual value.

Year

0

1

2

3

4

5

6

7

8

9

10

Depreciation

$0

$4,000

$4,000

$4,000

$4,000

$4,000

$4,000

$4,000

$4,000

$4,000

$4,000

Net Book Value

$50,000

$46,000

$42,000

$38,000

$34,000

$30,000

$26,000

$22,000

$18,000

$14,000

$10,000

The amount of depreciation will be included in the firm’s overhead expenses in Profit and Loss Account (P&L Account). And this annual depreciation charge will also be subtracted from the value of equipment under Current Assets in Balance Sheet.

Straight-Line Method – Evaluation

The key advantage of Straight-Line Method is that it is simple to understand and calculate. Hence, widely used by different limited companies.

However, depreciating Fixed Assets by the same amount each year throughout the asset’s lifespan is not very realistic. Many assets such as cars and trucks as well as computers and other IT equipment lose a much larger percentage of their value at the beginning of their lifespan due to fast advances in modern technology. Straight-Line Method does not reflect that as all depreciation charges are the same every year while the repairs and the maintenance costs of an asset tend to increase with age.

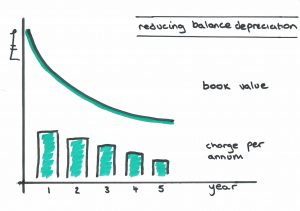

2. Reducing Balance Method

Reducing Balance Method of Depreciation is the more realistic one of the two methods; popular amongst U.S. companies.

This method depreciates the value of an asset by a predetermined percentage for the duration of its useful life. This reduces the value of an asset by a larger amount in the earlier year.

Source: https://financeinterim.co.uk/depreciation-rate-straight-line-or-reducing-balance

The Net Book Value of the asset is calculated by deducting the accumulated depreciation from the historic cost, the purchase cost of the assets.

Net Book Value = Purchase Cost of the Asset – Depreciation

The following formula is used to calculate depreciation using Reducing Balance Method:

Depreciation = Depreciation Rate (%) x Cost of the Asset (in a given year)

Example 3: New computers were bought for USD$50,000 and are expected to last ten years, when they will be replaced. The business chose to use Reducing Balance Method to depreciate the computers at an annual depreciation rate of 10%. This time, annual depreciation is not a fixed amount per year. The value of the asset at the end of each year is shown below. This method also leaves a residual value of USD$17,434 for the computers after ten years.

Year

0

1

2

3

4

5

6

7

8

9

10

Depreciation

$0

$5,000

$4,500

$4,050

$3,645

$3,281

$2,952

$2,657

$2,392

$2,152

$1,937

Net Book Value

$50,000

$45,000

$40,500

$36,450

$32,805

$29,524

$26,572

$23,915

$21,523

$19,371

$17,434

Reducing Balance Method – Evaluation

The key advantage of Reducing Balance Method is that it is more realistic in representing the rate of falling market value of Fixed Assets over time. It depreciates the asset at the faster rate in the first few years of the asset’s lifespan than in later years.

However, Reducing Balance Method is not as straightforward to calculate. And, it can be subjective in deciding on the annual rate of depreciation, unless specified by law. Also, it is unnecessary if the firm aims to spread the whole cost of an asset over its total useful lifespan.

In practice, it does not really matter which method is used to calculate depreciation. But, in order to allow for meaningful and historical comparisons, it is vital to be consistent in the choice of the method used.

Articles: 1,432 · Readers: 748,000 · Views: 2,231,258

Articles: 1,432 · Readers: 748,000 · Views: 2,231,258